Absa Bank Uganda has launched a three-year partnership with Junior Achievement Uganda (JAU) to deliver a comprehensive financial literacy and entrepreneurship programme targeting over 25,000 learners aged up to 25 years.

The initiative aims to equip young Ugandans with practical skills for sustainable livelihoods and the future world of work. It builds on Absa Group’s long-standing collaboration with Junior Achievement International, through which the bank has championed youth-focused education, entrepreneurship, and financial literacy programmes across Africa.

The programme engages students through hands-on experiential models such as the Company Programme, where learners create and manage mini-companies. Innovation and leadership camps are designed to nurture creativity, problem-solving, and leadership skills. The National Company of the Year Competition highlights student-run enterprises, while job shadowing opportunities provide learners with workplace exposure.

Participants also gain access to Absa’s Ready-to-Work online platform, offering training in finance, people management, entrepreneurship, and other essential workplace skills.

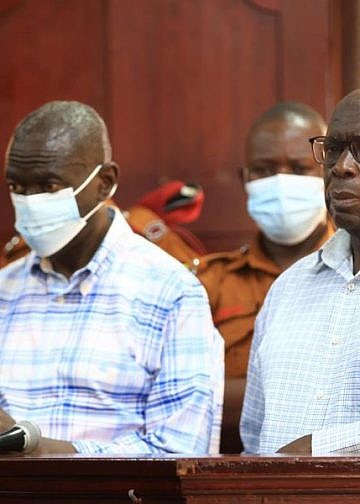

Speaking at the launch, Absa Bank Uganda Managing Director David Wandera emphasized the importance of financial literacy in building a sustainable financial system.

“By investing in young people’s financial literacy, we are helping them make responsible choices that open the door to financial freedom and long-term prosperity — for themselves and their communities,” Wandera said.

Absa employees will serve as mentors and trainers during boot camps, workshops, and events aligned with global observances such as World Youth Day, World Savings Day, and Global Entrepreneurship Week.

Junior Achievement Uganda Country Director Rachael Mwagale said the partnership will expand the programme’s reach to learners in Mukono, Mpigi, and Kampala, equipping the next generation with the confidence and skills to thrive in a rapidly evolving economy.

The collaboration aligns with Absa’s vision of promoting financial inclusion and developing financially competent consumers, ultimately contributing to a more resilient, knowledge-driven Ugandan economy.